Definition: Accounting profit, also called bookkeeping profit, is the net income that remains after subtracting the explicit costs from a firm’s total revenues in accordance with GAAP. These costs include labor costs, raw material costs, distribution costs, and other production expenses.

Definition: Accounting profit, also called bookkeeping profit, is the net income that remains after subtracting the explicit costs from a firm’s total revenues in accordance with GAAP. These costs include labor costs, raw material costs, distribution costs, and other production expenses.

What Does Accounting Profit Mean?

Contents [show]

What is the definition of accounting profit?

Accounting profit, often referred to as bookkeeping profit, serves as a fundamental measure of a company’s financial performance. Calculated by subtracting explicit costs from total revenue, it represents the net income reported on financial statements prepared under Generally Accepted Accounting Principles (GAAP). Understanding accounting profit is crucial for businesses, as it provides insights into cost management, operational efficiency, and overall profitability.

This is the net income reported on the all GAAP basis financial statements. Accountants subtract a firm’s explicit costs from the total revenues to calculate the accounting profit. Explicit costs are costs that can be clearly identified and measured. For example, labor costs are explicit costs because they represent a specific amount paid for wages during a given period.

All of the costs included in the calculation are amounts actually paid except depreciation expense. This represents the year’s ratable portion of the past outlay of cash required to purchase production equipment. Thus, this also is included.

Accountants do not consider implicit costs in this calculation because they haven’t been incurred and are merely theoretical. Implicit costs are used for the calculation of a firm’s economic profit.

Let’s look at an example.

Example

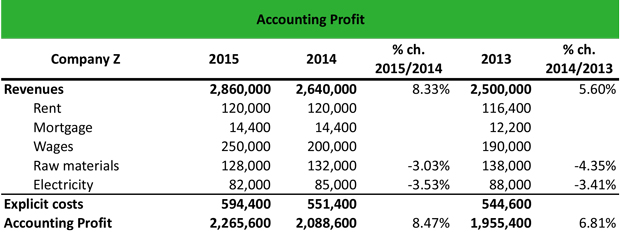

Mario, the chief accountant of a manufacturing company that sells air conditioners, asks his assistant to calculate the firm’s accounting profit over the past three years. Mario wants to confirm that the profit of the company is increasing, indicating that the company is effectively managing its costs.

The assistant creates an excel file with all the information he has for the firm’s operations in 2013, 2014, and 2015, i.e. total revenues and explicit costs (rent, mortgage, wages, raw materials and electricity expenses).

The assistant finds that the profit for the company in the fiscal year 2015 is $2.27 million, for 2014 is $2.09 million and for 2013 is $1.96 million. The increase of 8.47% YoY from 2014 to 2015 and of 6.81% YoY from 2013 to 2014 indicates that the firm implements effective strategies to lower its explicit costs and increase its revenues. Specifically, the revenue growth from 2013 to 2014 is 5.60% YoY and from 2014 to 2015 is 8.33% YoY.

Furthermore, the company has lowered its raw materials costs by 4.35% YoY from 2013 to 2014 and by 3.03% YoY from 2014 to 2015. Likewise, the electricity costs are reduced by 3.53% YoY from 2013 to 2014 and by 3.53% YoY from 2014 to 2015.

Accounting Profit vs. Economic Profit

While accounting profit is a critical metric, it is important to distinguish it from economic profit, which incorporates both explicit and implicit costs. Implicit costs, also known as opportunity costs, represent potential earnings from alternative uses of resources. For example, if a business owner invests $100,000 in their company instead of putting it in a savings account earning 5% interest, the foregone $5,000 is an implicit cost.

In contrast, accounting profit focuses solely on explicit costs—those that involve direct monetary payments, such as wages, rent, and raw materials. While this makes accounting profit easier to calculate and interpret, it provides a narrower view of profitability compared to economic profit.

Key Components of Accounting Profit

Accounting profit relies on three primary components:

Revenue

Total revenue includes all income generated from the sale of goods or services during a specific period. For example, a company selling electronics might report revenue from direct sales, warranties, and related services.

Explicit Costs

These are direct, measurable costs incurred during production and operations. Examples include salaries, rent, utility bills, and the cost of raw materials. Depreciation is also included as an explicit cost, reflecting the allocation of a prior capital expenditure over time.

Net Income

Net income is the result of subtracting explicit costs from total revenue. This figure represents the accounting profit and is reported on the company’s income statement.

Practical Applications of Accounting Profit

Accounting profit serves multiple purposes in business management and decision-making:

- Performance Evaluation: By analyzing trends in accounting profit, businesses can assess the effectiveness of cost control measures and revenue growth strategies.

- Budgeting and Forecasting: Accounting profit provides a basis for preparing budgets and forecasting future financial performance.

- Stakeholder Communication: Investors, creditors, and other stakeholders rely on accounting profit to evaluate a company’s financial health and operational success.

For example, a retail chain experiencing consistent increases in accounting profit might attract more investors, while declining profit could signal the need for operational adjustments.

Example: Cost Analysis and Accounting Profit

Consider a bakery generating $500,000 in annual revenue. Its explicit costs include $150,000 for ingredients, $100,000 for wages, $50,000 for rent, and $20,000 for utilities. Using these figures, the bakery’s accounting profit is calculated as:

Accounting Profit=Total Revenue−Explicit Costs\text{Accounting Profit} = \text{Total Revenue} – \text{Explicit Costs}Accounting Profit=Total Revenue−Explicit Costs Accounting Profit=500,000−(150,000+100,000+50,000+20,000)=180,000\text{Accounting Profit} = 500,000 – (150,000 + 100,000 + 50,000 + 20,000) = 180,000Accounting Profit=500,000−(150,000+100,000+50,000+20,000)=180,000

This profit figure allows the bakery’s management to evaluate its operational efficiency and identify areas for cost optimization, such as negotiating lower rent or reducing ingredient waste.

Limitations of Accounting Profit

While accounting profit is a valuable metric, it has certain limitations:

Exclusion of Implicit Costs: Accounting profit does not account for opportunity costs, potentially overstating a company’s financial health.

Short-Term Focus: Accounting profit reflects past performance but may not provide insights into long-term sustainability.

Dependence on Accounting Standards: Variations in accounting practices and assumptions, such as depreciation methods, can influence profit calculations.

For instance, two companies using different depreciation methods (straight-line vs. declining balance) may report different accounting profits, despite identical operational performance.

Enhancing Accounting Profit Through Cost Management

Businesses can improve their accounting profit by focusing on cost management strategies:

Reducing Variable Costs: Streamlining procurement processes or negotiating supplier contracts can lower expenses like raw materials.

Optimizing Fixed Costs: Evaluating fixed expenses, such as rent or salaries, for potential reductions without compromising quality or productivity.

Improving Operational Efficiency: Implementing lean production techniques and reducing waste can enhance overall profitability.

The Role of Technology in Managing Accounting Profit

Modern technology plays a pivotal role in calculating and analyzing accounting profit. Accounting software such as QuickBooks and Xero automates the tracking of revenues and explicit costs, reducing errors and saving time.

For example, a manufacturing company using an enterprise resource planning (ERP) system can integrate production data with financial records, providing real-time insights into cost structures and profit margins. This allows management to make informed decisions and respond proactively to changes in the business environment.

Accounting Profit and Decision-Making

Accounting profit is a critical input for various strategic decisions, such as pricing, expansion, and investment.

For instance, a company considering the launch of a new product can use projected accounting profit to determine feasibility. By analyzing expected revenues and explicit costs, the company can assess whether the initiative aligns with its financial goals.

Summary Definition

Define Accounting Profit: Accounting profit is the GAAP concept of where total revenue exceeds explicit costs.

Frequently Asked Questions

What is accounting profit?

Accounting profit is the net income a company earns after subtracting explicit costs, such as wages, rent, and materials, from total revenue. It is reported on financial statements prepared under GAAP.

How is accounting profit different from economic profit?

Accounting profit considers only explicit costs, while economic profit includes both explicit and implicit costs, like opportunity costs. Economic profit provides a broader view of profitability by factoring in alternative uses of resources.

Why is accounting profit important for businesses?

Accounting profit helps businesses assess operational efficiency, manage costs, and communicate financial performance to stakeholders. It supports decision-making and compliance with financial reporting standards.

What are the limitations of accounting profit?

Accounting profit excludes implicit costs, offering a limited view of total profitability. It also depends on accounting methods, which can vary and affect comparability between companies.

Bottom Line

Accounting profit is a fundamental measure of financial performance, reflecting the net income derived from a company’s operations after explicit costs are deducted. It provides a clear snapshot of profitability, supporting internal management, stakeholder communication, and compliance with accounting standards.

While accounting profit offers valuable insights, it should be analyzed alongside other metrics, such as economic profit and cash flow, to gain a comprehensive understanding of a company’s financial health. By leveraging modern technology and effective cost management strategies, businesses can optimize their accounting profit, ensuring sustainability and growth in an increasingly competitive market.